In competitive markets, it’s easy to feel like regular buyers are being pushed aside by massive investors. When homes sell quickly and offers fall through, the idea that “big companies are buying everything” starts to sound believable.

That belief grows even stronger when prices feel high and inventory feels tight.

But perception and reality aren’t always the same.

And when it comes to large institutional investors, the data tells a much calmer story than the headlines suggest.

Let’s look at what’s really happening with large institutional investors in today’s housing market – because the numbers tell a much different story than the headlines.

The Number Most People Won’t See Online

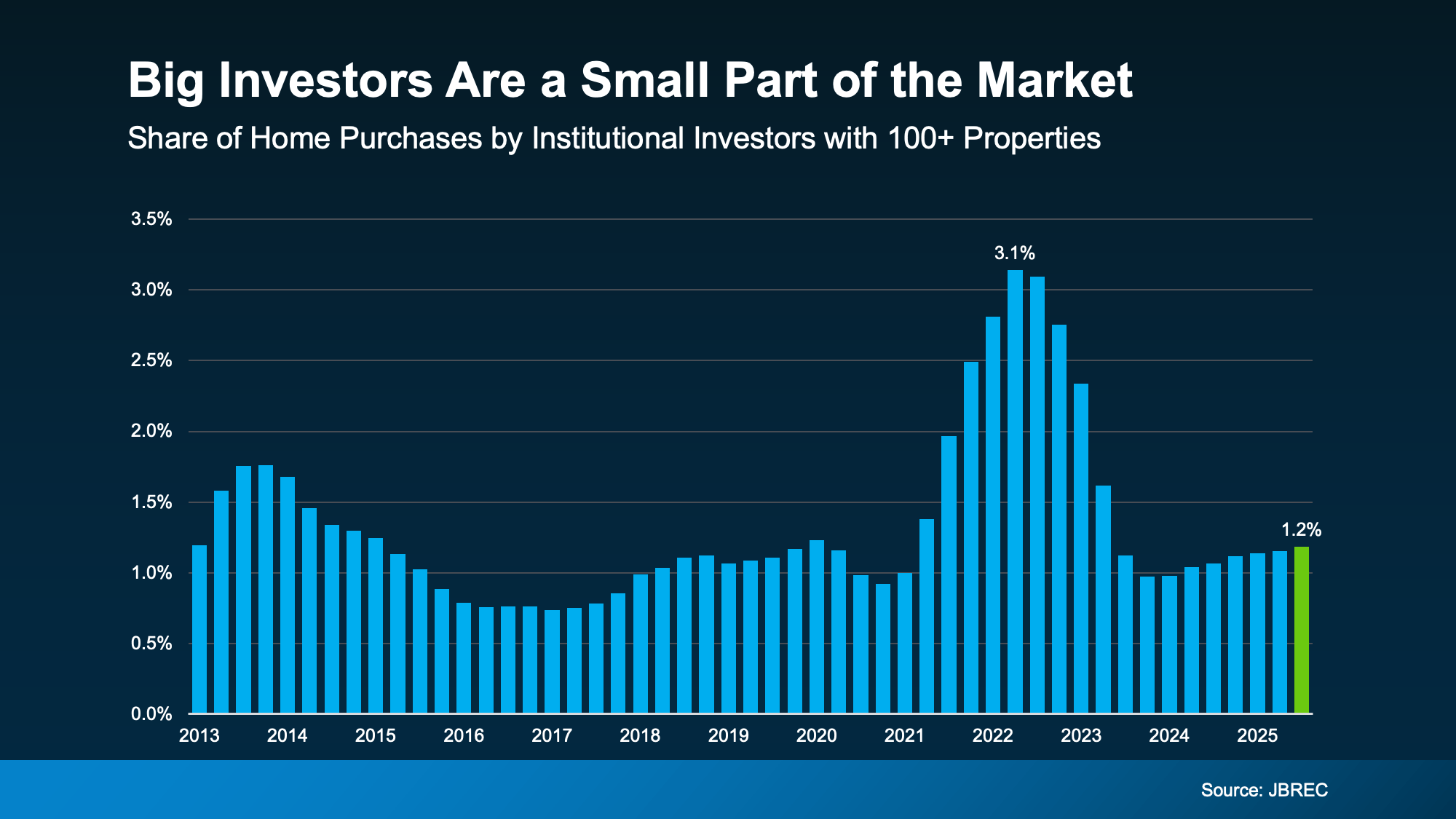

Let’s start with the most important stat. According to John Burns Research & Consulting (JBREC), large institutional investors – those that own 100 or more homes – made up just 1.2% of all home purchases in Q3 of 2025 (see graph below):

That’s it. Out of every 100 homes sold, only about 1 went to a large institutional investor.

That’s it. Out of every 100 homes sold, only about 1 went to a large institutional investor.

And here’s an important point that often gets missed: that level of investor activity is very much in line with historical norms. It’s not unusually high, and it’s actually well below the recent peak of 3.1% back in 2022 – which itself was still a small share of the overall market.

So, while it can feel like big investors are everywhere, nationally, they’re a very small part of overall home sales.

Why Investor Activity Gets So Much Attention

There are two main reasons this topic gets so much attention:

- Investor activity isn’t spread evenly.Investors are more active in certain markets, which can make competition feel intense for homebuyers in those areas. As Lance Lambert, Co-Founder of ResiClub, explains:“On a national level, “large investors”—those owning at least 100 single-family homes—only own around 1% of total single-family housing stock. That said, in a handful of regional housing markets, institutional and large single-family landlords have a much larger presence.”

- Investor is a broad term.Part of what makes the share of purchases bought by investors sound so big is because many headlines lump large Wall Street institutions together with small, local investors (like your neighbor who owns one or two rental homes). But those are very different buyers.In reality, most investors are small, local owners, not massive corporations. And when all investors get grouped together in the headlines as a single stat, it inflates the number and makes it seem like big institutions are dominating the market (even though they’re not).

Yes, big investors exist. Yes, they buy homes. But nationally, they’re responsible for a very small share of total purchases – far smaller than most people assume.

The bigger affordability challenges have much more to do with supply, demand, and years of underbuilding than with large institutions competing with everyday buyers.

That’s why it’s so important to separate noise from reality, especially if you’re trying to decide if now is the right time to move.

Want to Know What This Really Means for Your Local Market?

What matters most isn’t what the headlines say. It’s what’s actually happening where you’re looking to buy.

Some neighborhoods feel more competitive than others. Some see more investor activity. Others are dominated by everyday buyers and families. That’s why local insight makes all the difference.

If you want to understand how investor activity plays out in your area and what it means for your buying options, let’s connect. A little clarity about your market can replace a lot of unnecessary doubt.