If you’re a homeowner planning to move this year, you may be thinking about buying and selling a home in Chicago at the same time and wondering what the process looks like or what to tackle first.

-

Should you sell before buying your next place, or try to coordinate both moves together?

-

How do you avoid juggling two mortgages or ending up without a place to stay in between?

Ultimately, the answer depends on your goals and current market conditions. And that’s where an agent’s experience can really help make your next step clear. Learn more about our experienced agents like Megan Wilson.

They know your local market, the latest trends, and what’s working for other homeowners right now. And they’ll be able to make a recommendation based on their expertise and your needs.

But here’s a little sneak peek: For most move-up Chicago buyers and downsizers, selling your current home before buying your next one puts you in a stronger position and can make the transition between homes less stressful.

Here’s why that order tends to work best (and how an experienced real estate agent for selling and buying can help).

The Advantages of Selling First

1. You’ll Unlock Your Home Equity

Selling your current home before you try to buy your next one allows you to access the equity you’ve built up, and based on home price appreciation over the past few years, that’s no small number. Explore the benefits of multi-generational homebuying.

Data from Cotality (formerly CoreLogic) shows the average homeowner is sitting on $302,000 in equity today.

And once you sell, you can use that equity to pay for the down payment on your next house (and maybe even more). You may even have enough to buy your next Chicago home in cash. That’s a big deal, and it could make your next move a whole lot easier on your wallet. Not sure where you’ll go after selling? Get tips here.

2. You Won’t Be Juggling Two Mortgages

Trying to buy before you sell means you could wind up juggling two mortgages, even if just for a few months. That can get expensive, fast – especially if there are unexpected repairs or delays.

Selling first removes that stress and helps you move forward without the financial strain.

As Ramsey Solutions says:

“It’s best to sell your old home before buying a new one to avoid unnecessary risks and possible headaches.”

3. You’ll Be in a Stronger Position When You Make an Offer

Sellers love a clean, simple offer.

If you’ve already sold your house, you don’t need to make your offer contingent on that sale, and that can help you stand out. Your agent can position your offer to be as strong as possible, so you have the best shot at getting the home you want. Understand your options to avoid foreclosure if timing is a challenge.

This can be a big advantage in competitive markets where sellers prefer buyers with fewer strings attached.

One Thing To Keep in Mind

But, like with anything in life, there are tradeoffs. As you weigh your options, consider this potential drawback, too:

1. You May Need a Place To Stay (Temporarily)

Once your house sells, you may need a short-term rental or to stay with family until you can move into your next home.

Your agent can help you negotiate a home sale contingency, a post-closing occupancy, or flexible closing dates to smooth out the transition between homes. Discover what to do if you’re struggling to find a home to buy.

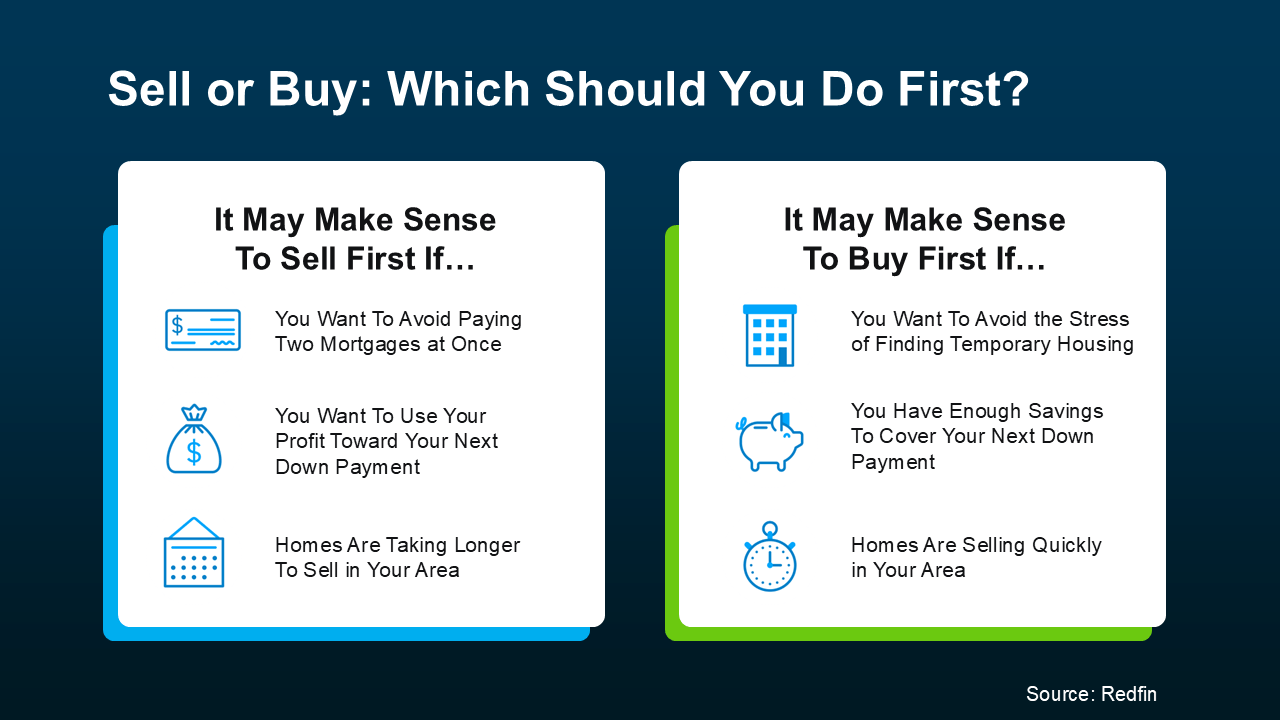

Here’s a simple visual that can help you think through your options (see below):

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

Ready to Make Your Move?

In many cases, selling first doesn’t just give you clarity, it gives you options. It helps you buy with more confidence, more financial power, and less pressure.

If you’re a move-up buyer, downsizer, or first-time seller and you’re not sure where to begin, book a free consultation with our team. We’ll walk you through your potential equity, timing, and local market conditions so you can make the right move with confidence. Get the truth about today’s Chicago housing market.