You’ve been waiting for what feels like forever for mortgage rates to budge, finally.

And last week, they did – in a big way.

On Friday, September 5th, the average 30-year fixed mortgage rate fell to the lowest level since October 2024.

It was the most significant one-day decline in over a year.

What Sparked the Drop?

According to Mortgage News Daily, this was a reaction to the August jobs report, which came out weaker-than-expected for a second month in a row.

That sent signals across the financial markets, and then mortgage rates came down as a result.

Basically, we’re seeing signs the economy may be slowing down, and as certainty grows in the direction the economy is going, the markets are reacting to what is likely ahead.

That historically brings mortgage rates down.

Why Buyers Should Pay Attention Now

But this isn’t just about one day of headlines or one report. It’s about what the drop means for you.

This recent change saves you money when you buy a home.

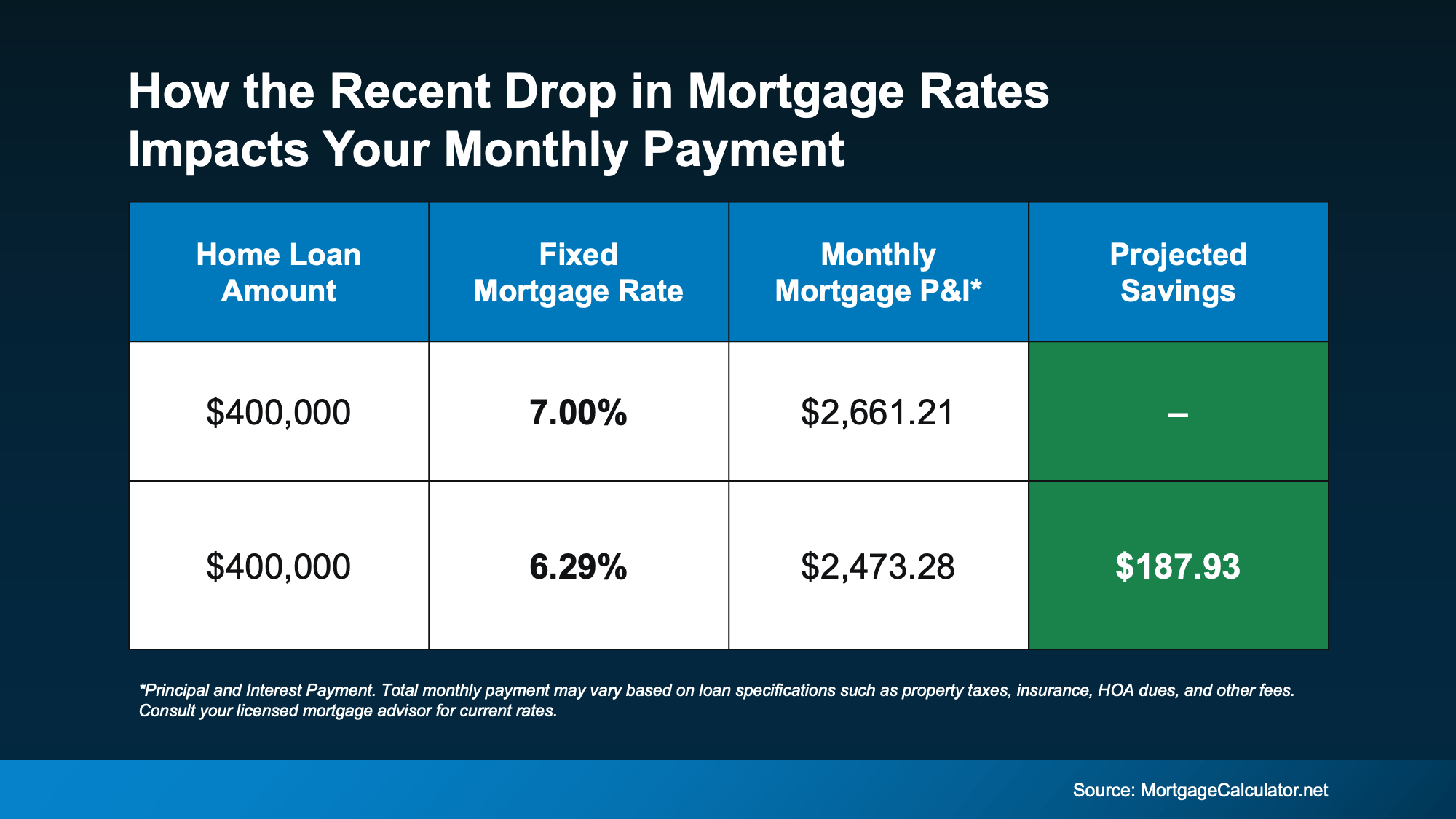

The chart below shows you an example of what a monthly mortgage payment (principal and interest) would be at 7% (where mortgage rates were in May) versus where rates are now:

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

How Long Will It Last?

That really depends on where the economy and inflation go from here. Rates could drop lower, or they could inch up slightly.

So, make sure you’re connected with a good agent and trusted lender.

They’ll keep a close eye on inflation indicators, job market updates, and reactions to upcoming Fed policy to gauge where mortgage rates may go from here.

But for now, focus on this.

While no one can say for sure where rates are headed, the fact that rates broke out of their months-long rut is a good thing.

If you’ve been feeling stuck, this could make the start of a new chapter.

As Diana Olick, Senior Real Estate and Climate Correspondent at CNBC, says:

“Rates are finally breaking out of the high 6% range, where they’ve been stuck for months.”

And that’s gives you more reason to hope than you’ve had in quite some time.

Your Next Move Starts Here

This is the shift you’ve been waiting for.

Mortgage rates just saw their biggest decline in over a year. And if rates stay near this level, it could make a home you couldn’t afford just a few months ago feel possible again.

What would today’s rates save you on your future monthly payment? Let’s connect so you can find out.