For the past couple of years, it’s been tough for many homebuyers to make the numbers work. Home prices shot up. Mortgage rates, too. And several people hit pause because it just didn’t feel possible.

Maybe you were one of them.

But there’s some encouraging news.

If you’ve been waiting for a better time to jump back in, affordability may finally be showing signs of improvement this fall.

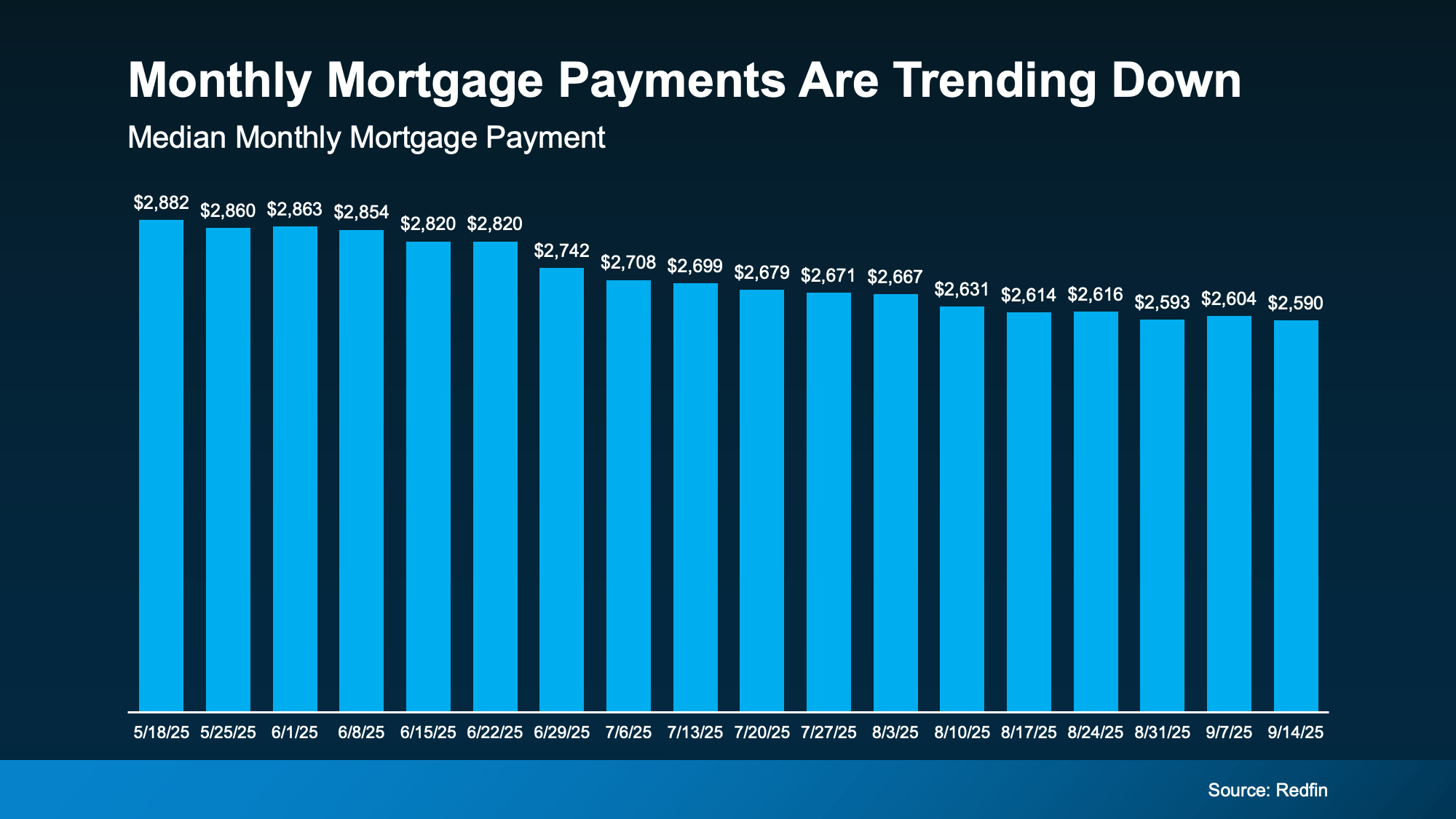

The latest data from Redfin shows the typical monthly mortgage payment has been coming down, and is now about $290 lower than it was just a few months ago (see graph below):

Why is this happening?

Why is this happening?

The cost of buying a home really comes down to three things:

- Mortgage rates

- Home prices

- Your wages

Right now, all three are finally moving in a better direction for you. While that doesn’t mean it’s suddenly easy to buy at today’s rates and prices, it does mean it’s not as challenging.

1. Mortgage Rates

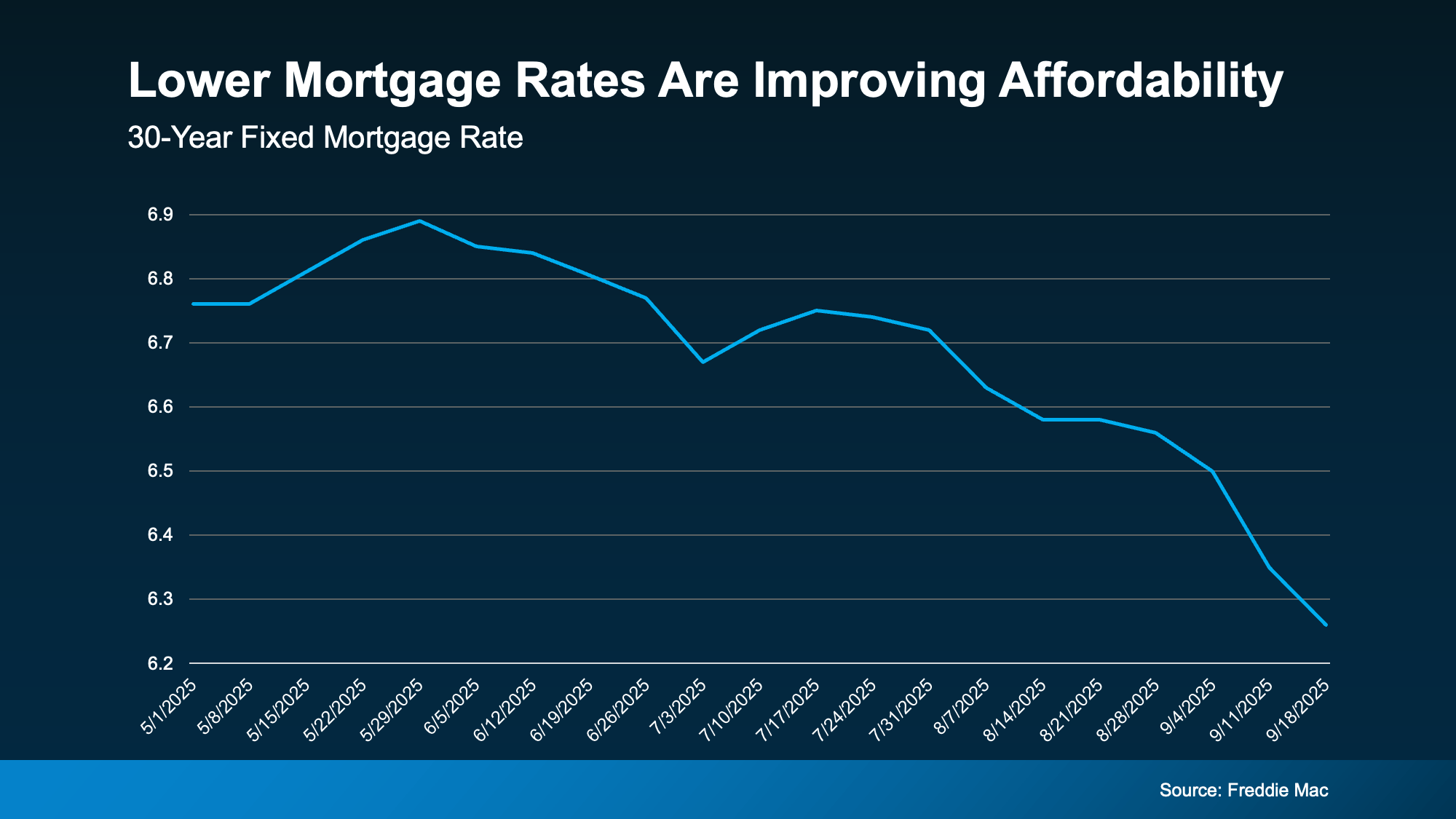

Mortgage rates have come down compared to earlier this year. In May, they were roughly 7%. And now, they’re closer to 6.3% (see graph below):

That may not sound like a big deal, but it does matter. Even small changes in rates can make a difference in your future monthly payment.

That may not sound like a big deal, but it does matter. Even small changes in rates can make a difference in your future monthly payment.

Compared to when rates were 7%, if you take out an average $400K mortgage now at 6.3%, it’ll cost about $190 less a month based on just rates alone.

And for some people, that’s been enough to make rebuying a home possible.

As Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explained on September 10th:

“The downward rate movement spurred the strongest week of borrower demand since 2022 . . . Purchase applications increased to the highest level since July and continued to run more than 20 percent ahead of last year’s pace.”

2. Home Prices

After several years of rapid price growth, it has finally slowed.

As Odeta Kushi, Deputy Chief Economist at First American, puts it:

“National home price growth remains positive, but muted — low single digits — and we expect this trend to continue in the second half of the year.”

For buyers, that’s actually a big relief. That moderation makes it easier to plan your budget. And in some markets, prices have even dipped slightly.

If you’re in one of the markets, you may be able to find something that’s more affordable than you’d expect.

3. Wages

According to the Bureau of Labor Statistics (BLS), wages are up near 4% annually.

Lawrence Yun, Chief Economist at NAR, explains why that number is so important right now:

“Wage growth is now comfortably outpacing home price growth, and buyers have more choices.”

In other words, the typical paycheck is rising faster than home prices right now, which helps make buying a little more affordable.

Now, it’s not a big difference, but in a market like this, every bit counts.

What This Means for You

Lower rates, slower price growth, and stronger wages might be enough to make the numbers finally work for you this fall.

While affordability is still tight, it’s a little easier on your wallet to buy now than it was just a few months ago (home projects boost value).

Remember, data from Redfin shows the typical monthly mortgage payment is already around $290 lower than it was earlier this year.

Ready to Buy? Let’s Run the Numbers

Have you been wondering if it’s worth taking another look at buying?

Let’s run the numbers together.

We can review your budget, assess the changes, and determine if this fall is the right time to turn window-shopping into key-turning.