More homeowners are rethinking how much space they really need as retirement gets closer.

Downsizing isn’t about giving up comfort. For many homeowners, it’s about simplifying life, reducing upkeep, and making housing decisions that better fit the years ahead.

For a growing number of homeowners, retirement isn’t some distant idea anymore. It’s starting to feel very real.

According to Realtor.com and the Census, nearly 12,000 people will turn 65 every day for the next two years. And the latest data shows as many as 15% of those older Americans are planning to retire in 2026. And another 23% will do the same in 2027.

If you’re considering retiring soon too, here’s what you should be thinking about.

Why Downsize?

Now’s the perfect time to reflect on what you want your life to look like in retirement. Because even though your finances will be going through a big change, you don’t necessarily want to feel like you’re living with less.

But odds are, what you do want is for life to feel easier.

- Easier to enjoy.

- Easier to manage.

- Easier to maintain day-to-day.

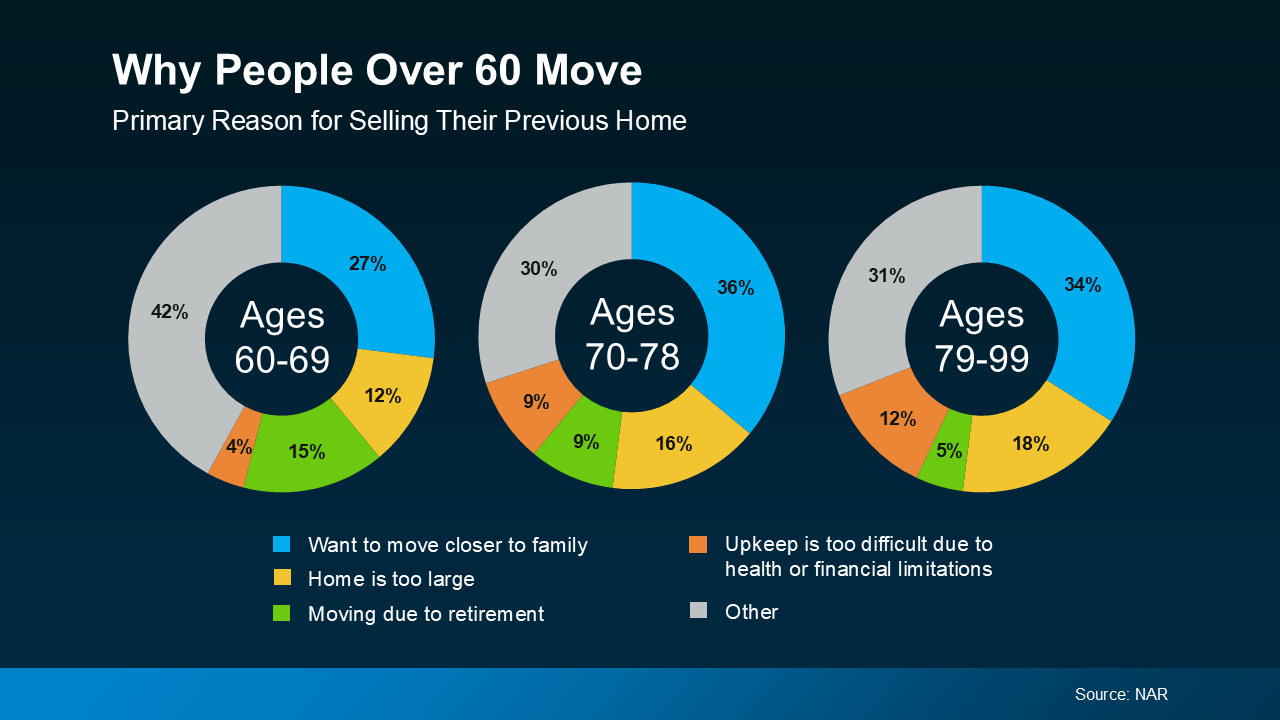

The Top Reasons People Over 60 Move

You can see these benefits show up in the data when you look at why people over 60 are moving.

The National Association of Realtors (NAR) finds the top 4 reasons aren’t about timing the market or chasing top dollar. They’re about lifestyle:

- Being closer to children, grandchildren, or long-time friends so it’s easier to spend more time with the people who matter most

- Wanting a smaller, more functional home with fewer stairs and easier upkeep

- Retiring and no longer needing to live near the office, so it’s easier to move wherever you want

- Opting for something smaller to reduce monthly expenses tied to utilities, insurance, and maintenance

No matter the reason, the theme is the same: downsizing isn’t about giving something up. It’s about gaining control and choosing simplicity. And it brings peace of mind to know your home fits the years ahead, not the years behind.

And the best part? It’s more financially feasible now than many homeowners would expect.

The #1 Thing Helping So Many Homeowners Downsize

Here’s the part that makes it possible. Thanks to how much home values have grown over the years, many longtime homeowners are realizing they’re in a stronger position than they thought to make that move.

According to Cotality, the average homeowner today has about $299,000 in home equity. And for older Americans, that number is often even higher – simply because they’ve lived in their homes longer.

When you stay in one place for years (or even decades), two things happen at the same time:

- Your home value has time to grow.

- Your mortgage balance shrinks or disappears altogether.

That combination creates more options than you’d expect, even in today’s market.

So, whether you just retired, or you’re about to, it’s not too soon to start thinking about what comes next. Sure, it can be hard to leave the house you made so many years of memories in, but maybe it’s time to close one chapter to open a new one that’s just as exciting.

Talk to a Real Estate Professional Before You Downsize

Downsizing is about setting yourself up for what comes next — on your terms.

If retirement is on the horizon and you’re wondering what your current home and equity could make possible, the smartest first step isn’t selling right away. It’s getting clarity.

A trusted real estate agent or local market expert can help you understand your downsizing options, timing, and whether selling your house now or later makes the most sense.

Let’s talk. A simple, no-pressure conversation with a real estate professional can help you decide your next move with confidence.