If you’re planning to buy a home this year, there’s one expense you can’t afford to overlook: closing costs.

Almost every buyer knows they exist, but not that many know exactly what they cover, or how different they can be based on where you’re buying. So, let’s break them down.

What Are Closing Costs?

Your closing costs are the additional fees and payments you make when finalizing your home purchase. Every buyer has them. According to Freddie Mac, they typically include things like homeowner insurance and title insurance, as well as various fees for your:

- Loan application

- Credit report

- Loan origination

- Home appraisal

- Home inspection

- Property survey

- Attorney

More about “Real Estate Agent Fees”

National vs. Local: Why the Numbers Look So Different

When you search for information about closing costs online, you’ll often see a national range, usually 2% to 5% of the home’s purchase price.

While that’s a useful starting point if you’re working on your homebuying budget, it doesn’t tell the whole story.

In reality, your closing costs will also vary based on:

- Taxes and fees where you live (like transfer taxes and recording fees)

- Service costs for things like title and attorney work in your local area

While the home price is obviously going to matter, state laws, tax rates, and even the going costs for title and attorney services can change what you expect to pay.

That’s why it’s important to talk to the pros ahead of time so you know what to budget for. It can put you in control before you even start shopping.

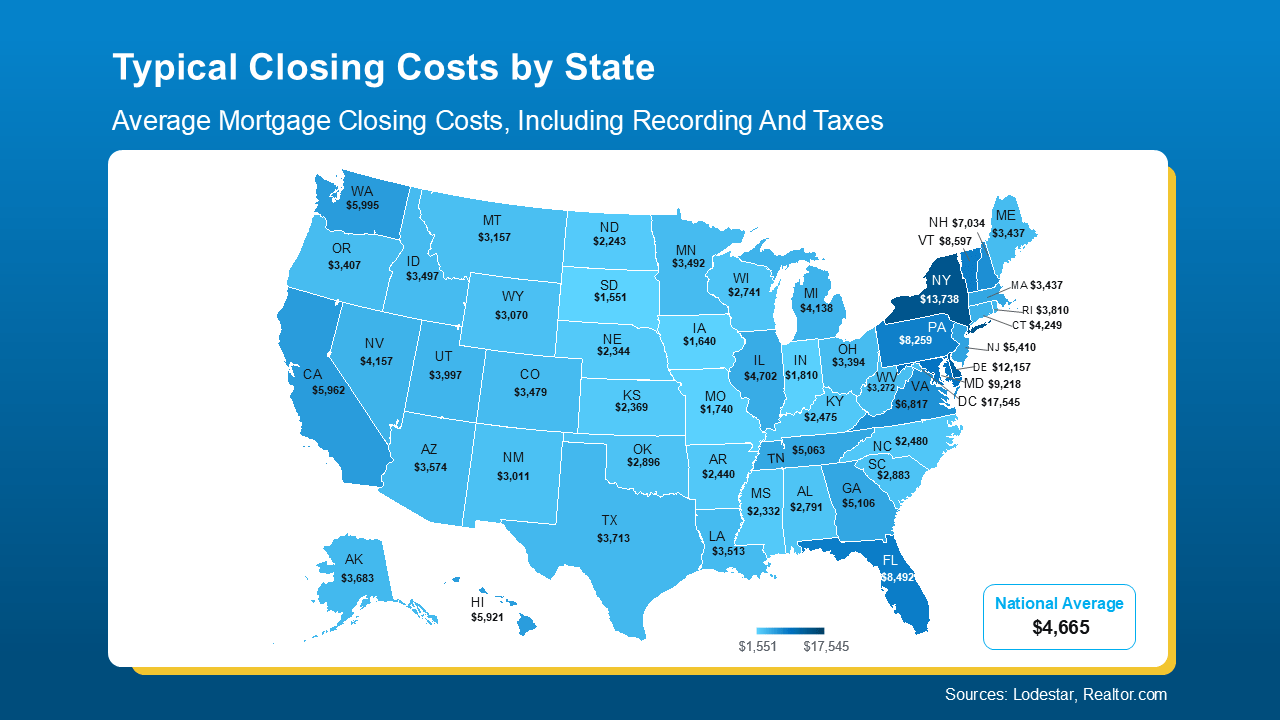

To give you a rough ballpark, here’s a state-by-state look at typical closing costs right now based on those factors for the median-priced home in each state (see map below):

As the map shows, in some states, typical closing costs are just roughly $1-3K. In a few places, they can be closer to $10-15K. That’s a big swing, especially if you’re buying your first home. And that’s why knowing what to expect matters.

As the map shows, in some states, typical closing costs are just roughly $1-3K. In a few places, they can be closer to $10-15K. That’s a big swing, especially if you’re buying your first home. And that’s why knowing what to expect matters.

If you want a real number to help with your budget, your best bet is to talk to a local agent and a lender. They can run the math for your price range, loan type, and exact location.

And just in case you’re looking at your state’s number and wondering if there’s any way to trim that bill, NerdWallet shares a few strategies that can help:

- Negotiate with the seller. Ask for concessions like a credit toward your closing costs.

- Shop around for homeowner’s insurance. Compare coverage and rates before you commit.

- Check for assistance programs. Some states, professions, and neighborhoods offer help. Your agent and lender can point you to what’s available locally.

Work With a Local Realtor Who Knows the Numbers

Closing costs are a key part of buying a home, but they can vary more than most people realize. Knowing your numbers (and how to potentially bring them down) can go a long way and help you feel confident about your purchase.

If you’re wondering what my house is worth or need guidance from experienced real estate brokers in Chicago, we’re here to help.

Let’s connect today so we can review your budget, closing costs, and housing goals. A trusted local realtor can walk you through the numbers and give you a personalized estimate for your next move.