A lot of people are asking the same question right now: “Is it even a good time to sell my house?”

If you live in Chicago, you may be asking that too — especially if you’ve owned your home for a while and aren’t sure what your next move could look like.

For many homeowners, the answer comes down to one powerful factor they already have working in their favor: equity. In fact, using home equity to move may open up more options than you expect—and could completely change how you think about selling your house.

The Hidden Wealth of Homeownership

Here’s how it works. When you own a home, you build up something called equity.

Each time you make a mortgage payment, you’re chipping away at your loan balance. And that helps your ownership stake in your home grow. At the same time, home values typically rise – which drives up the overall value of your home.

When you put those two things together, you’re building wealth automatically, month after month, year after year.

And that combo can add up to real dollars that can make a real difference in your move. That’s especially true if you’ve lived in your house for a while, which many homeowners have. According to Realtor.com:

“Nearly half (45.2%) of today’s homeowners have lived in their home for more than 15 years, and 1 in 4 for over 25 years.”

If that’s you, just imagine what 15-25 years of payments + steady appreciation have done to your bottom line. It’s time you see how your equity stacks up over time.

What That Really Means in Dollars

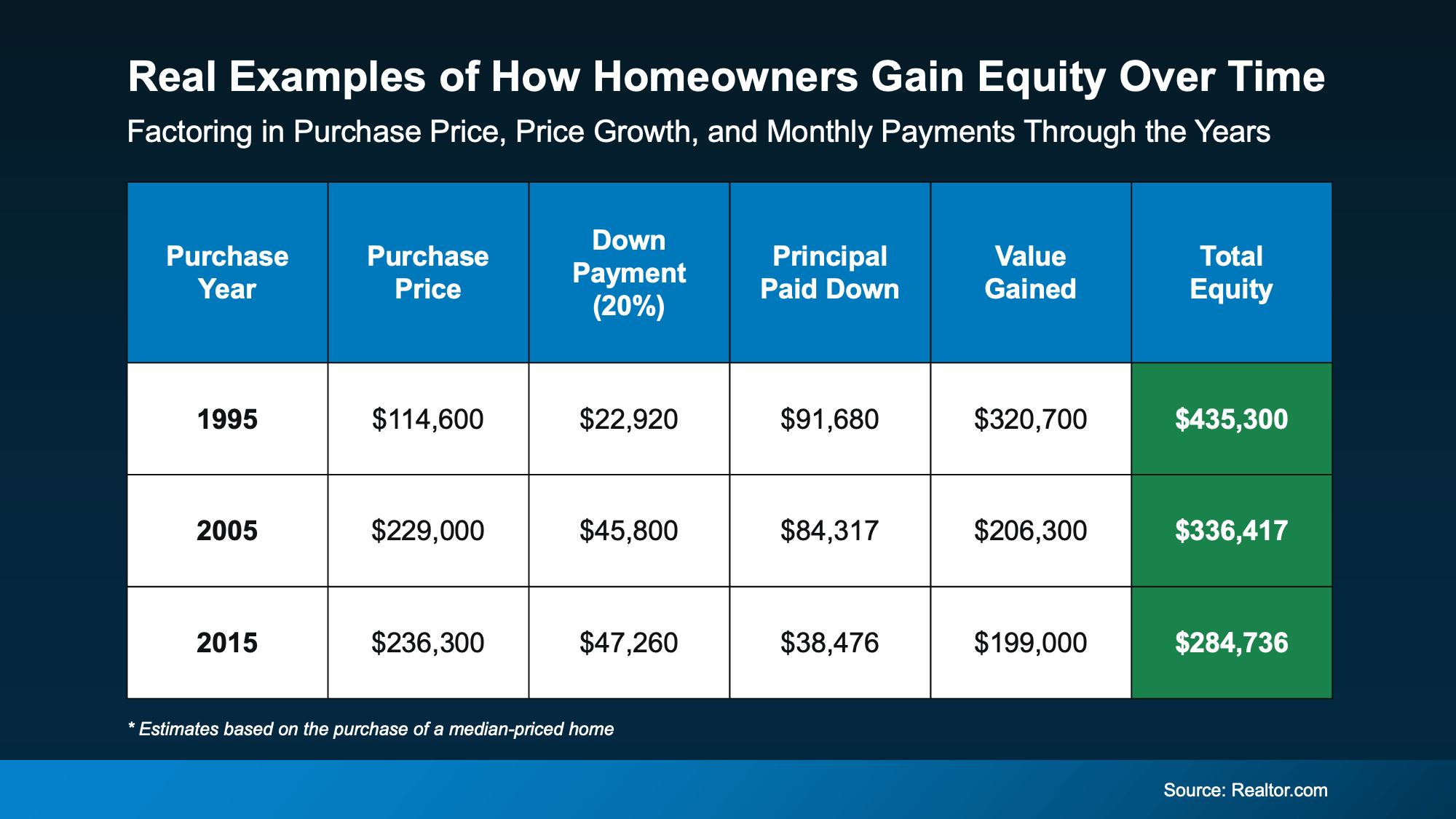

This chart uses research coming out of Realtor.com to show an estimate of how much equity homeowners have built up depending on when they bought.

For each time frame, it takes the median-priced home and uses it as the baseline example. The numbers are shocking, too. According to the study, if you bought the average-priced home in…

- The mid-90s? You could be sitting on over $400,000 in equity now.

- The early 2000s? You could have over $330,000, even with owning during the housing crash.

- In 2015? Even in that shorter 10-year time frame, many homeowners have already built nearly $285,000 in equity.

Of course, your actual number is going to vary based on the purchase price, any work you’ve done to the house, the size of your original down payment, and more. The point is…

Of course, your actual number is going to vary based on the purchase price, any work you’ve done to the house, the size of your original down payment, and more. The point is…

A lot of homeowners are sitting on hundreds of thousands of dollars in equity without even realizing it.

Your Equity Could Power Your Next Move

Here’s where this becomes really important. That equity can offset nearly every concern you have about moving right now.

- Worried about taking on a higher mortgage rate? Your equity could cover a significant down payment. And the more money you put down, the less you need to finance at today’s rates.

- Unsure if you can compete in today’s market? Thanks to your equity, you may be able to buy your next house in cash. And an all-cash offer is something that’s going to appeal to a lot of sellers because they don’t have to worry about their buyer’s financing falling through at the last second.

How Your Home Equity Can Help You Sell With Confidence

If you’ve been searching online for “sell my house” or “sell my house in Chicago,” understanding your equity is a smart place to start. Knowing what your home is worth—and how much equity you’ve built—can give you clarity before you make any decisions.

Your equity could help you sell on your timeline, reduce financial stress in your next move, or even open doors to stronger buying options. And for owners thinking about selling a home — or even a retail property — having a clear equity picture puts you in control.

If you want a custom, professional equity assessment, let’s connect and walk through how using home equity to move could work for you.

- KM Realty Group LLC

- 111 N Wabash Ave STE 1734, Chicago, IL 60602 (Directions)

- Call Us: (312) 283-0794

- Chat with Tammy Jackson