Foreclosure headlines are making noise again – and they’re designed to stir up fear to get you to read them. But what the data shows is actually happening in the market tells a very different story from what you might be led to believe. So, before you jump to conclusions, it’s important to look at the full picture.

Yes, foreclosure starts are up 7% in the first six months of the year. But zooming out shows that’s nowhere near crisis levels. Here’s why.

Filings Are Still Far Below Crash Levels

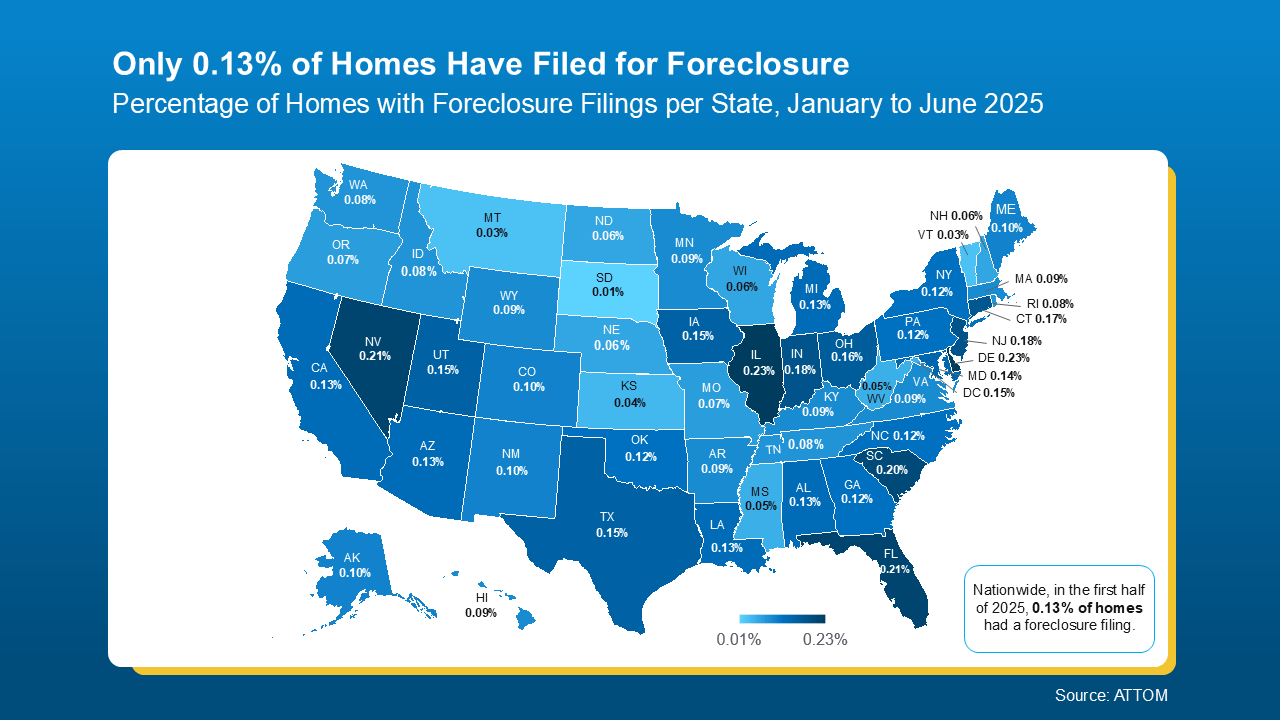

Even with the recent uptick, overall foreclosure filings are still very low. In the first half of 2025, just 0.13% of homes had filed for foreclosure. That’s less than 1% of homes in this country.

It’s even far less than that, at under a quarter of a percent. That’s a very small fraction of all the homes out there. But like with anything else in real estate, the numbers vary by market.

If you’re looking to understand what this means for your area, talking to a trusted Chicago Realtor can give you local insight beyond national headlines.

Here’s the map you need to see that shows how foreclosure rates are lower than you might think, and how they differ by local area:

For context, data from ATTOM shows in the first half of 2025, 1 in every 758 homes nationwide had a foreclosure filing. Thats the 0.13% you can see in the map above. But in 2010, back during the crash? Mortgage News Daily says it was 1 in every 45 homes.

For context, data from ATTOM shows in the first half of 2025, 1 in every 758 homes nationwide had a foreclosure filing. Thats the 0.13% you can see in the map above. But in 2010, back during the crash? Mortgage News Daily says it was 1 in every 45 homes.

Today’s Numbers Don’t Indicate a Market in Trouble

But here’s what everyone remembers…

Leading up to the crash, risky lending practices left homeowners with payments they eventually couldn’t afford. That led to a situation where many homeowners were underwater on their mortgages.

When they couldn’t make their payments, they had no choice but to walk away. Foreclosures surged, and the market ultimately crashed.

Today’s housing market is very different. Lending standards are stronger. Homeowners have near-record levels of equity. And when someone hits financial trouble, that equity means many people can sell their home rather than face foreclosure. As Rick Sharga, Founder of CJ Patrick Company, explains:

“. . . a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

No one wants to see a homeowner struggle. But if you’re a homeowner facing hardship, talk to your mortgage provider. You may have more options than you think.

Bottom Line

Recent headlines may not tell the whole story, but the data does. Foreclosure activity remains low by historical standards and is not a sign of another crash.

If you’re keeping an eye on the housing market and wondering how it’s affecting your home’s value, let’s connect.

With our trusted real estate team at KM Realty Group LLC, one of the top real estate companies in Chicago, Illinois, we’ll help you separate fact from fear by clearly breaking down what the data shows.