Renting can feel much less expensive and much simpler than buying a home, especially right now. For many people, starting with homes for rent in Chicago feels like the easiest option.

No repairs, no property taxes, no worrying about mortgage rates – you pay the bill and move on with your life.

But here’s the part people don’t talk about enough: renting doesn’t help you build your financial future. Meanwhile, homeowners grow their net worth just by owning a home.

So, if you’ve been wondering whether buying is still worth it, the long-term math is more straightforward than you might think.

Renting vs. Owning: How the Costs Really Compare

Let’s break down one of the key differences between renting and buying. When you rent, your payment goes to your landlord, and then it’s gone. When you own, part of your payment goes back to you in the form of equity (the wealth you build as your home’s value increases and you pay down your home loan).

So, while renting may seem more affordable now, you have to remember it comes at a long-term cost: you’re not building your wealth. And it turns out, that’s a bigger miss than you may expect.

Long-term Financial Impact

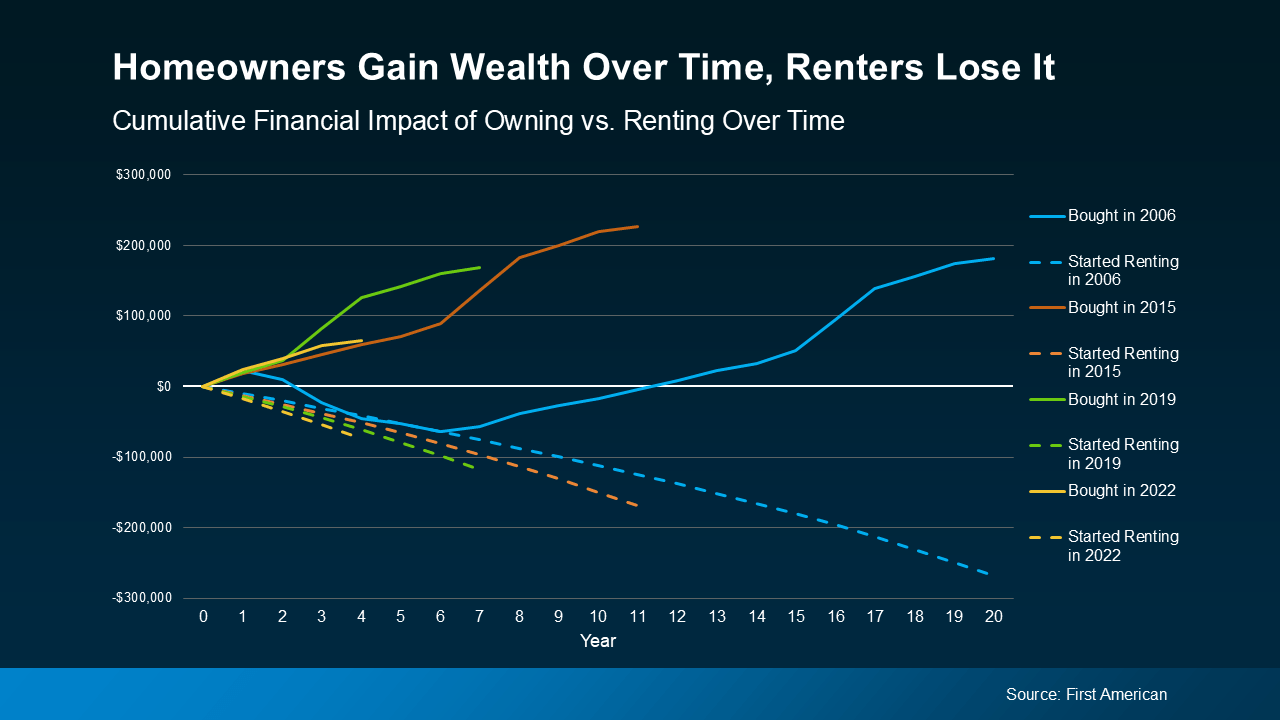

First American recently analyzed the long-term financial impact of renting versus owning a home.

They compared mortgage payments, property tax, insurance, repairs, and maintenance against the equity gained through home price appreciation and paying down the mortgage. And they did that during several different time frames to see if it tells a consistent story:

- 2006: the start of the housing bubble

- 2015: 10 years ago

- 2019: just before the pandemic (the last normal years in the market)

- 2022: when mortgage rates jumped

In each time frame, two things were true:

- Renters ended up with a loss over time

- Homeowners gained significant wealth

Here’s some data so you can see this play out.

Each color represents one of the key time frames. The solid lines show the buyer’s investment over time and how their net worth actually grew the longer they lived in their home. The dashed line represents the renter’s investment.

In the end, they sank more and more cash into renting without gaining any financial benefit.

The takeaway is simple: time in a home builds wealth. Time renting doesn’t.

The takeaway is simple: time in a home builds wealth. Time renting doesn’t.

Basically, homeowners come out ahead. And the analysis shows that’s even after you factor in the other expenses that come with homeownership, like insurance, repairs, and property taxes. And that’s the case for every time frame First American looked into.

On the flip side, renters spent money on their rent, but didn’t gain any long-term financial benefit. That’s true no matter what window of time you look at in the study.

Now, that doesn’t mean buying always beats renting in the short term. But the longer you own, the wider the wealth gap becomes.

Affordability Is Starting To Improve

You might still be thinking, “Okay, but buying feels out of reach for me right now.” Fair.

The past few years haven’t been easy for buyers. But things are starting to shift. Mortgage rates have come down this year, home prices are softening, and incomes have been rising. And according to Zillow, typical monthly payments have gotten a little easier compared to this time last year. Not by a lot, but enough to make a difference.

No, buying isn’t suddenly easy. But it is easier than it was just a few months ago. And in the long run, history shows it’s worth it.

Ready to Explore Your Options?

Renting may make sense for some stages of life, especially if flexibility matters right now. Exploring homes for rent in Chicago can be a smart short-term step while you prepare for ownership.

If you’re weighing rent versus buy, understanding both paths helps you make a decision that fits your goals — today and long term.

Thinking About Buying a Home in Chicago? Let’s Talk.

We can walk through your numbers, see what’s realistic, and help you understand your options — no pressure.

- KM Realty Group LLC

- 111 N Wabash Ave STE 1734, Chicago, IL 60602 (Directions)

- Call Us: (312) 283-0794