Buying a home is exciting… until you start thinking about the down payment. That’s when the worry can set in.

“I’ll never save enough.”

“I need a small fortune just to get started.”

“I guess I’ll just rent forever.”

Sound familiar? You’re not alone. And you’re not out of luck.

Here’s the thing: a lot of what you’ve heard about down payments just isn’t true. And once you know the facts, you might realize you’re a lot closer to owning a home than you think.

Let’s break it all down and bust some big down payment myths while we’re at it.

Myth 1: “I need to come up with a big down payment.”

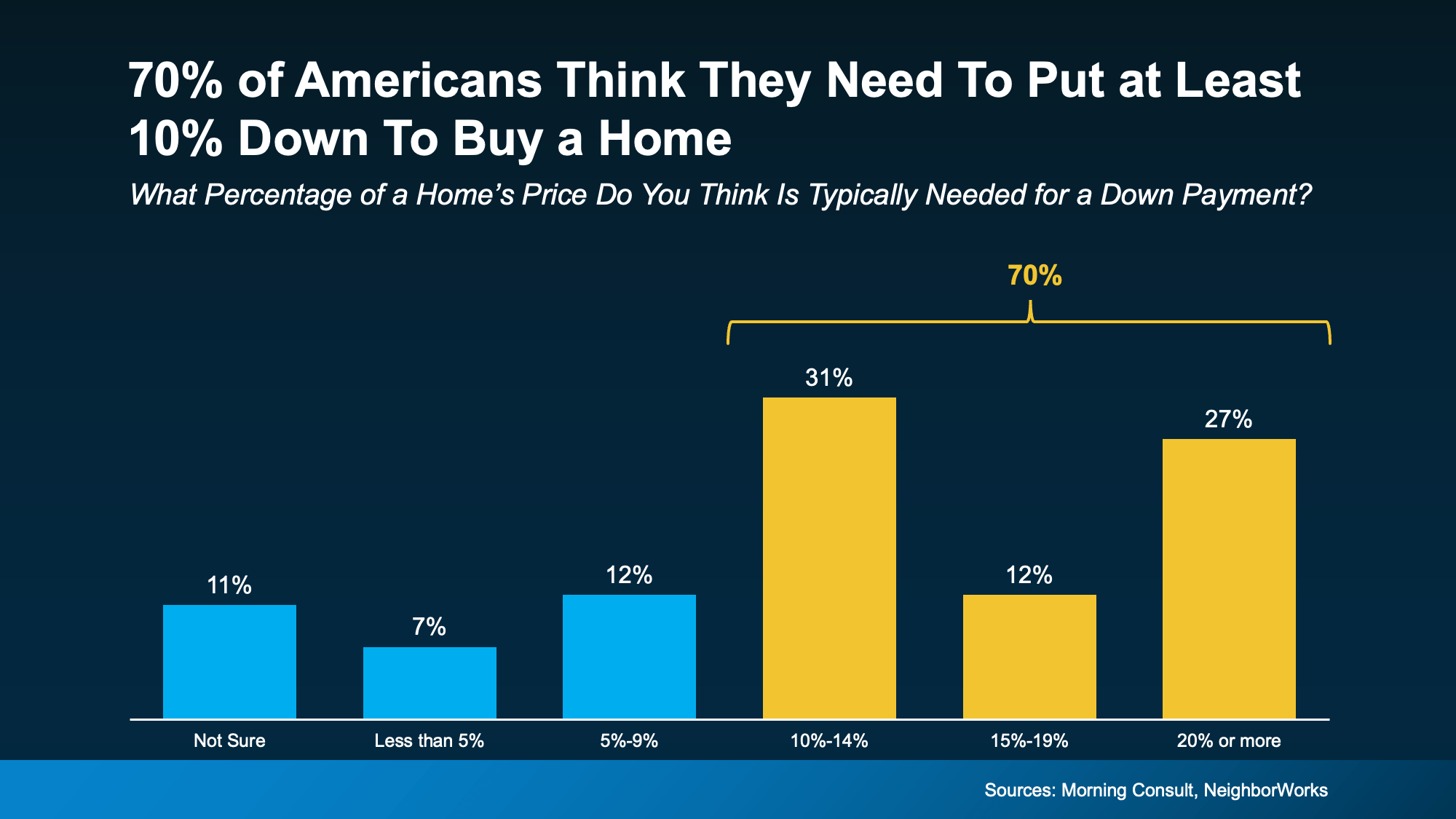

This one stops a lot of people in their tracks. A recent poll from Morning Consult and NeighborWorks shows 70% of Americans think they need to put at least 10% down to buy a home in Chicago. And 11% aren’t sure what’s required at all (see graph below):

The truth?

The truth?

According to the National Association of Realtors (NAR), the typical down payment for first-time homebuyers has been between 6% and 9% since 2018. But there’s more to the story.

If you qualify for an FHA loan, you may only need to put 3.5% down. And VA loans typically don’t require a down payment at all. So, there are options out there that can really make a difference for some buyers.

Myth 2: “It’ll take forever to save up for a down payment.”

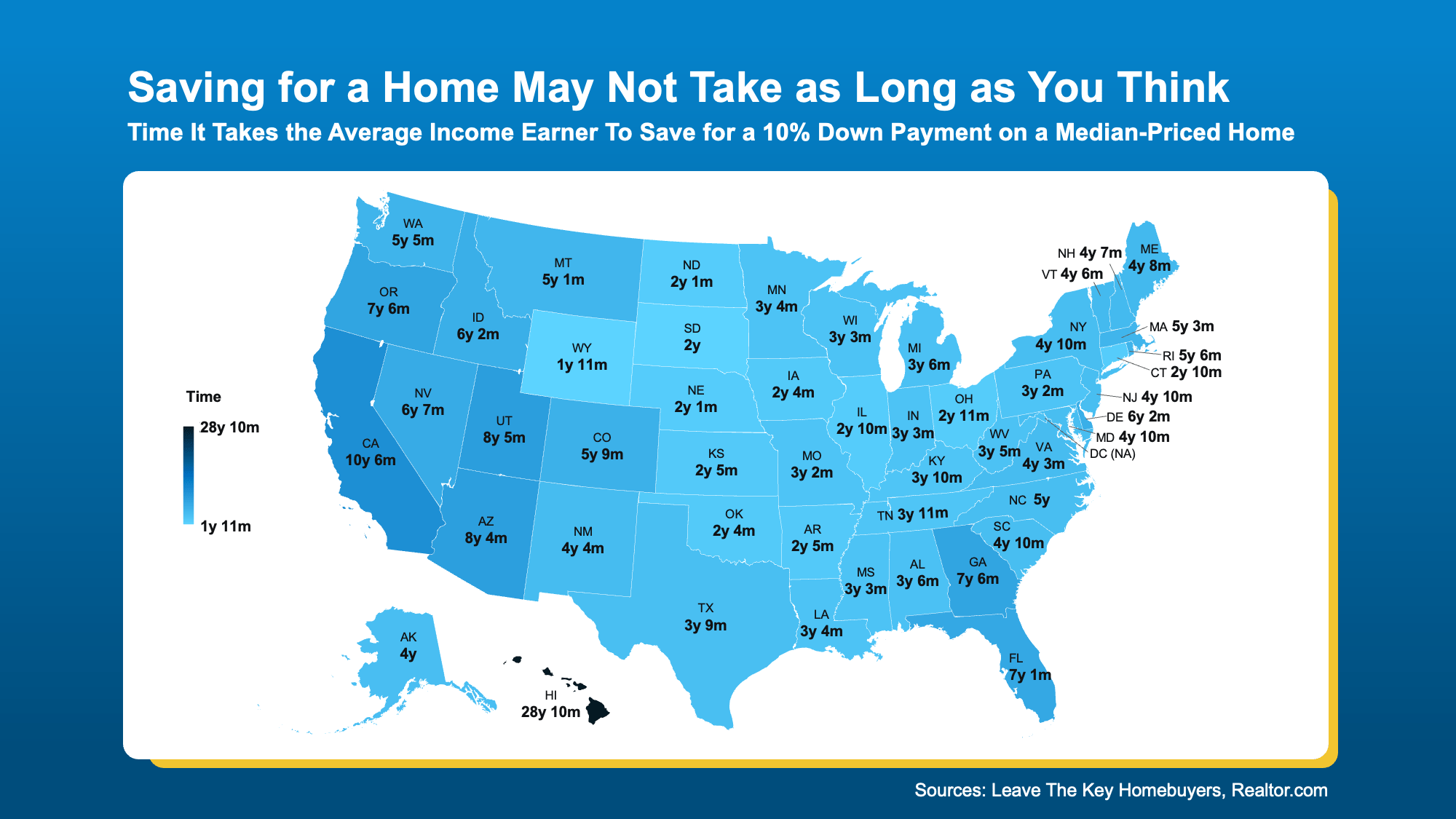

Sure, saving can take time. But it may not have to be as long as you think. In many states, reaching your goal can happen faster than you might expect, especially when you know your budget and have a clear savings plan.

According to a new study, the amount of time varies depending on where you live. The map below shows, on average, how many years it takes to save up for a 10% down payment based on typical home values and income levels in each state (see map below):

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.

Myth 3: “I have to do it all on my own.”

This is one of the biggest myths.

The reality is that there are thousands of down payment assistance programs, and a Morning Consult and NeighborWorks poll shows that 39% of people don’t even know about them. That means many potential homebuyers may already be closer to homeownership – they just don’t realize it.

These assistance programs are designed to help people like you who are ready to own a home but just need a little support getting started. As Miki Adams, President at CBC Mortgage Agency, explains:

“With high interest rates and soaring home prices, down payment assistance is more essential than ever.”

Bottom Line

If you’ve been putting off buying a home because the down payment feels like too much to tackle, talk to a trusted Chicago realtor at KM Realty Group LLC today.

You may not need as much as you think, and there are plenty of resources out there, so you don’t have to do it alone. You just need an expert to point you in the right direction.

If a down payment wasn’t holding you back, would you be ready to start your home search?

- KM Realty Group LLC

- 111 N Wabash Ave #1734, Chicago, IL 60602 (Directions)

- (312) 283-0794