Not every homebuyer wants the biggest house on the block.

Some want something more straightforward, more affordable, and easier to maintain, especially in a market where every dollar counts.

That’s where condos come in.

For first-time buyers, they can be a smart way to get into homeownership without stretching your budget.

For downsizers, they offer less space to maintain, with the flexibility to stay in a great location.

And right now, condos are one of the most buyer-friendly parts of the market.

Condo Inventory Is Up, And That Means More Choice

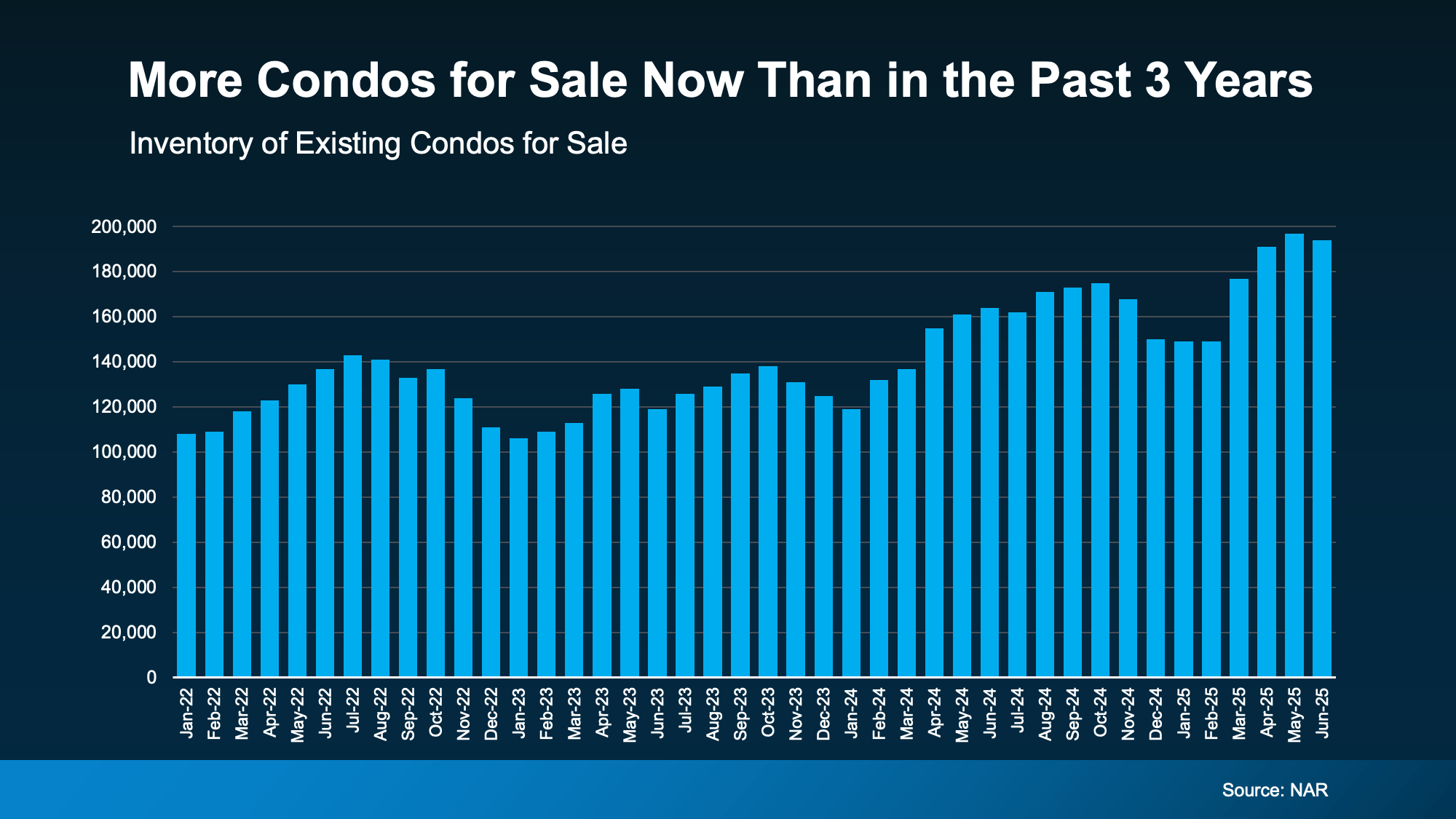

According to the National Association of Realtors (NAR), there are 194,000 condos for sale right now. That’s the second-highest amount we’ve seen in the last three years (see graph below):

[Find over 5,200 Condos for Sale in Chicago, Illinois from top realtors.]

Just remember, this is the national figure. The exact number is going to vary based on where you’re looking to buy. But, generally speaking, you have more options and less competition.

You’re not stuck waiting for something to pop up or rushing into an offer just to beat someone else to it. You’ve got plenty to choose from.

And if you’re particular about layout, location, or amenities, this is your chance to be selective.

That’s a big shift from the market frenzy of just a few years ago.

Compared to early 2022, we’ve got nearly double the condos available now. That gives you more breathing room to find the right fit.

Prices Are Cooling, and Buyers Hold More Negotiating Power

And since there are more for sale, many sellers are more open to negotiating right now. So, you may be able to get a better price.

To make the most of your negotiation, you can get a free Chicago home value estimate to know what similar properties are truly worth.

As Redfin explains:

“. . . condo buyers in many cities may be able to find sellers who are willing to give concessions and/or sell for less than their asking price.”

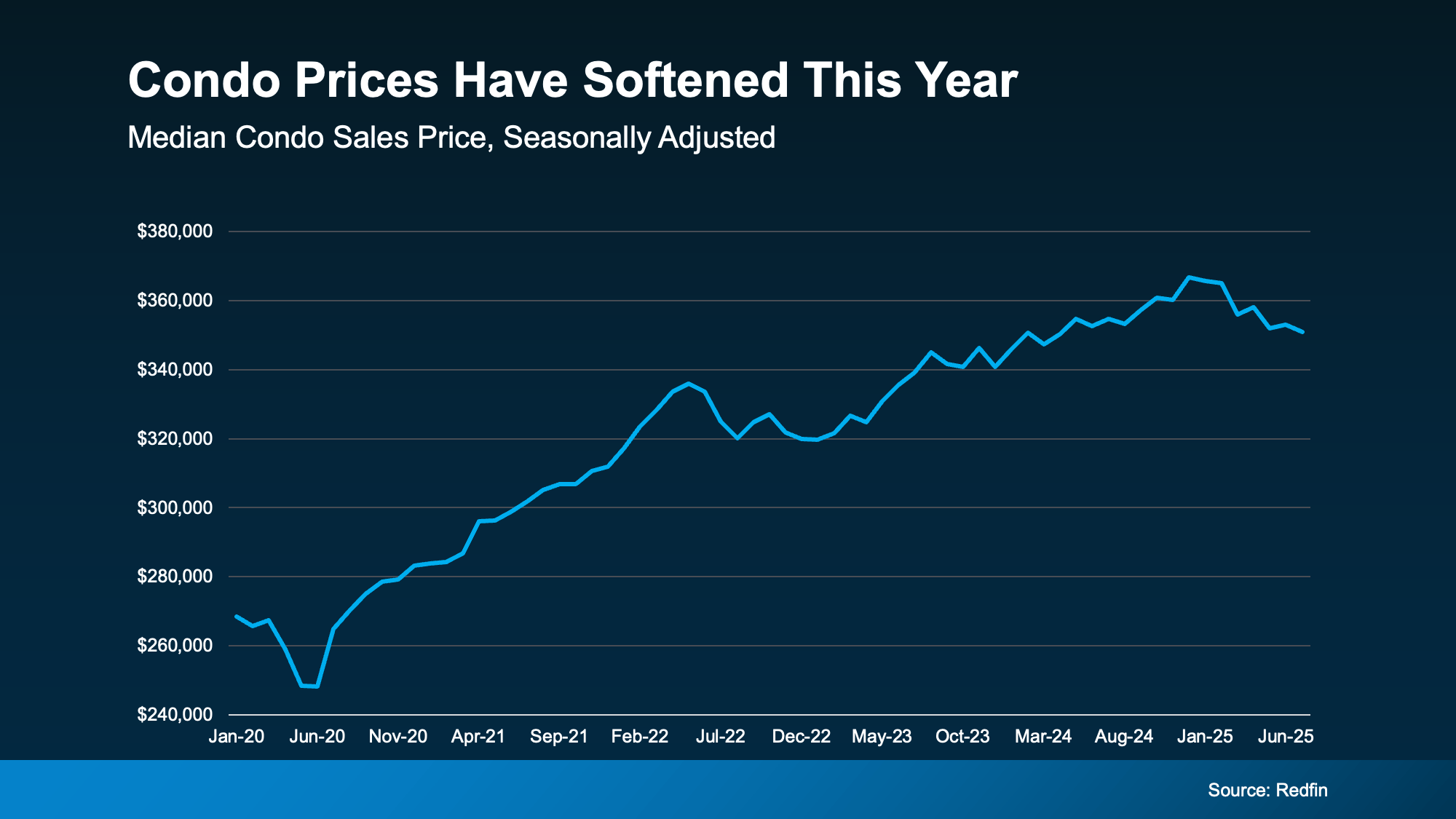

Condo prices are starting to ease in many markets. According to Intercontinental Exchange (ICE), condo prices dipped 1.3% in June compared to last year.

And over half of the top 100 U.S. metros saw condo prices drop slightly year-over-year.

Data from Redfin shows what the recent dip in prices looks like (see graph below):

That doesn’t just help with affordability, it also shifts the power dynamic. Condo buyers in many markets are now in a position to negotiate on price and ask for concessions, like help with closing costs.

Thinking About a Condo? Let’s Make a Smart Move in Chicago

Condos aren’t just a fallback option.

In today’s market, they’re one of the most strategic ways to buy. With more options, softening prices, and more room to negotiate, now could be the right time to make your move.

Could a condo check more boxes than you expected? Let’s talk through your options and find out if one of the many available Chicago condos could be the right move for you.