The rise in remote work is changing what many Americans want in their homes. Many companies are choosing to delay reopening or go remote full-time, and today’s buyers are looking for homes with more space to support their work needs.

As a seller, if you no longer need the extra room you have in your home, rest assured there are buyers who do.

Remote Work Is Here To Stay.

Remote work remains a reality for many Americans. A recent poll from Garter, Inc. shows many organizations have not yet returned their offices:

“. . . 66% of organizations are delaying reopening their offices due to new COVID-19 variants.”

And it’s not just companies that are choosing to remain remote for the time being – workers are seeking more flexibility. According to research from PricewaterhouseCoopers, nearly one-fifth of employees want to be fully remote in the future. The study also finds that many people are leaving jobs to seek out remote work opportunities:

“Among employees looking for new jobs, almost one in ten say it’s because they moved away from the office while working remotely and don’t want to go back on-site.”

More Remote Work Means a Greater Need for Home Offices.

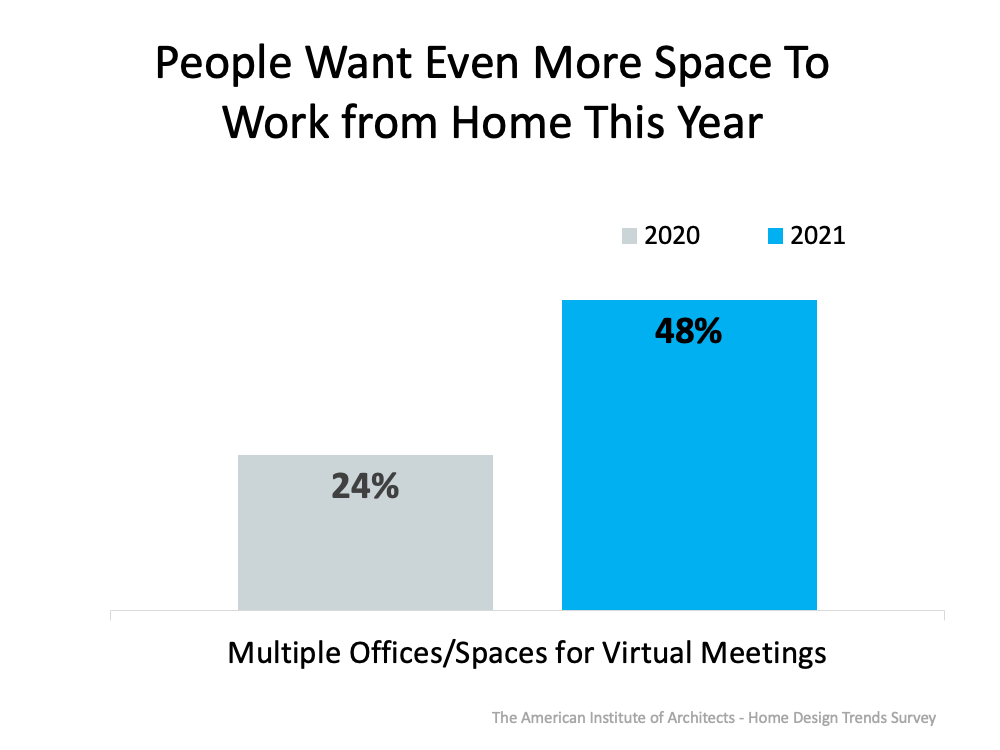

That’s leading today’s buyers to prioritize finding homes with more space so they can comfortably work from home. The 2021 Home Design Trends Survey from the American Institute of Architects finds that 69% of surveyed individuals still want at least one office at home.

However, it also shows that more people are looking for multiple spaces in their homes for remote work and virtual meetings (see graph below):

What Does This Mean for You?

If your house has extra space you no longer need, buyers are interested and now may be the perfect time to sell.

Your trusted real estate advisor can help you highlight many of the most sought-after features in your listing, including home offices. On the other hand, if you have an extra room without a purpose, consider staging it as an area where remote work can happen.

Your agent can also help you with this by evaluating and preparing your space for potential buyers. They’ll recommend how to stage the room, where to draw the eye, and what other sellers do to make their houses stand out.

Bottom Line.

With the continued rise in remote work, more buyers are looking for homes supporting multiple home offices. Consider selling if you have an extra room you’re no longer using.

Let’s connect today with real estate agents at KM Realty Group LLC, Chicago, to discuss the unique features of your house and how you can capitalize on any extra space to appeal to today’s buyers.